Deep Dive: Danelfin—Is This AI Stock Scoring Tool a Game-Changer or Just Hype?

Vivi Carter · 21, July 2025

Why Analyze Another AI Stock Picker?

This series is about dissecting the hottest AI-powered products making money overseas, especially those relevant for indie makers and small teams seeking practical growth hacks. Today’s spotlight: Danelfin.com, a platform claiming its AI stock scoring can help you consistently beat the market—boasting that its top picks averaged 14% better annual returns than the S&P 500 since 2017.

With AI-driven investing now a global trend (see WSJ coverage), understanding the mechanics behind tools like Danelfin isn’t just about FOMO. Instead, it’s a masterclass in how to build credibility, growth, and leverage AI for trust in a skeptical, high-stakes domain.

Danelfin’s Mission: AI-Powered Investing for “Everyman” Traders

Retail investors drown daily in an ocean of headlines, financial data, charts, and expert noise. Emotional decision-making rules, and most people lose—“retail churn” is Wall Street’s open secret. Danelfin pitches itself as a remedy for that problem.

Core Value Propositions:

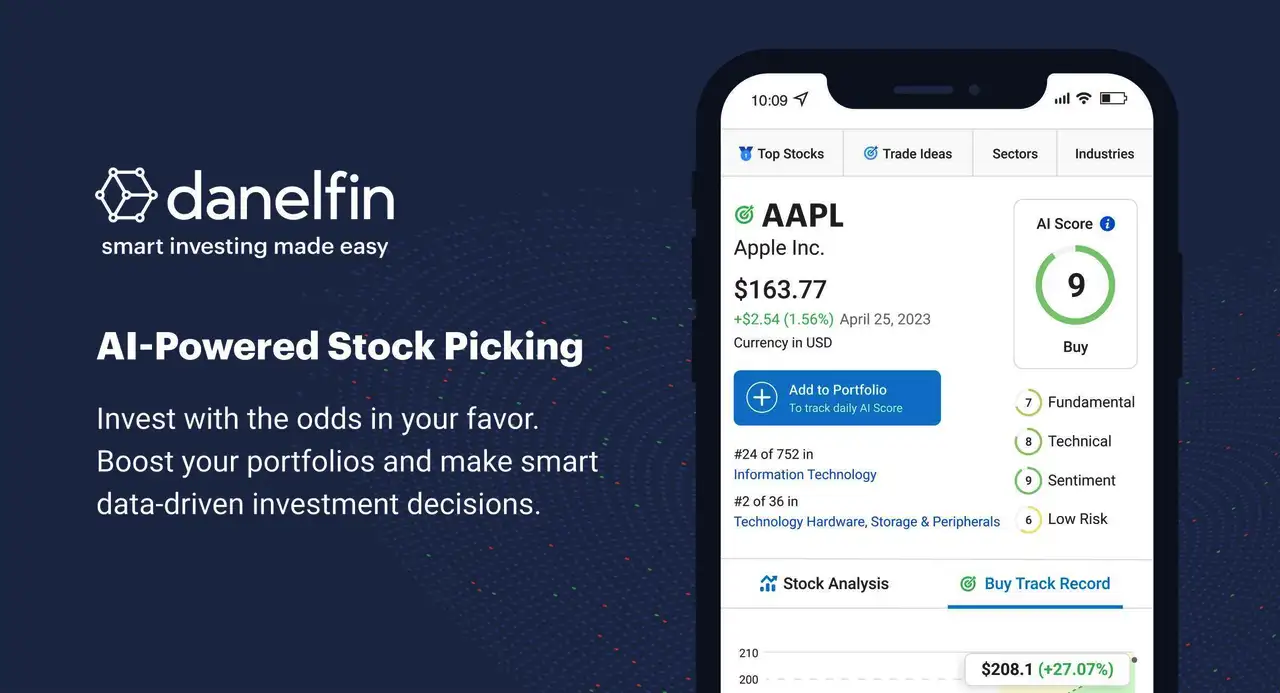

AI Score (1-10)

Every listed stock gets a daily score based on over 10,000 features—blending 600+ technical signals, 150+ fundamentals, and 150+ sentiment markers. The higher the score, the greater the AI-rated chance of outperforming the market over the next 3 months.

Explainable AI, Not Black Box

Unlike many tools that spit out “buy/sell” calls with zero logic, Danelfin makes its “Alpha Signals” transparent, displaying which factors most heavily influenced a stock’s score. This “explainability” is key for building user trust.

Track Record on Display

Danelfin doesn’t just promise—every performance claim is backed by historical backtests. Since 2017, “10/10” AI stocks outpaced the market by an average of 14.7% annually, while “1/10” stocks lagged by 37% (Performance claims).

Not a Fly-by-Night Startup

Founded in 2016, launched as an AI platform in 2021, Danelfin had years to quietly build before the AI investing craze went mainstream.

A Founder with Dual Cred: Tech Scale + Personal Pain

Tomás Diago, founder and CEO, has pedigree.

He previously founded Softonic, one of the world’s largest software download portals. The leap from software distribution to fintech is less random than it seems—after making his own investing mistakes (information overload, analysis paralysis), he’s channeling both his product-building chops and investor pain points into Danelfin. Add a genuine financial certification after his tech success, and you get a rare blend: successful tech founder, real user empathy, and legitimate market know-how.

Breaking Down the Product: How Does Danelfin Work?

| Core Feature | What It Does | Why It Matters |

| AI Score | Ranks every stock 1-10 for likely outperformance over 3 months. | Quick filtering, less choice overload. |

| Sub-Scores | Splits AI score into technical, fundamental, sentiment dimensions. | Supports varied investing styles. |

| Explainable AI | Shows key signals affecting the AI score and resulting insights. | Transparency, not “trust the black box.” |

| Performance Data | Showcases historical outcomes for each AI rating. | Hard evidence, not just claims. |

| Trade Ideas | Auto-generates buy/sell ideas with win rates based on history. | Implementation-ready, not just theory. |

| Portfolio Tool | Lets you track your holdings’ changing AI scores over time. | Makes portfolio management dynamic. |

In short: Danelfin tries to “do the research for you”—digesting complex signals into a single, actionable score, with receipts and logic upfront.

The Business Model: Classic Freemium, Smartly Deployed

Free

Access to basic AI scores, but limited to 10 stock reports/month and one portfolio of up to 5 holdings.

Plus ($25/mo, $19/mo annual)

All reports and ranking unlocked, unlimited portfolio tracking—sweet spot for active retail traders.

Pro ($70/mo, $52/mo annual)

Full unlock with pro features like CSV export and historical AI scoring, clearly targeting more advanced users.

All plans start with a 14-day free trial.

The smart bit

Free users are inevitably “teased”—the moment their curiosity deepens, the friction from report or portfolio limits nudges an upgrade.

Growth Engine: How Danelfin Built Its Organic Snowball

Slow, Heavy, Deliberate Build (a Sharp Contrast to Typical “Fast MVPs”)

Five-Year Stealth R&D:

Danelfin spent from 2016 to 2021 in heads-down model-building—no product launch until their team felt the AI was truly robust. This patience is rare in “move fast” startup culture, but it’s possible here because credibility and accuracy matter far more than speed in fintech.> For financial prediction platforms, reliability is the core moat, not surface features.

SEO and Content Flywheel: Product-As-Content

Danelfin’s real masterstroke?

Turning the product itself into a perpetually updated, SEO-optimized content network:

Unique Pages for Thousands of Stocks:

Every stock gets a rich, live-updating detail page: AI score, breakdowns, key signals, company bio, in-depth FAQ, and more. If a user Googles any ticker with “analysis” or “forecast,” Danelfin has top-ranking answers.

Automated Blogging:

With weekly “AI Trade Idea” posts and market recaps, all directly powered by the platform’s own rankings and AI.

The result: Every score update, every stock, every week—becomes new, indexable content for Google—fuel for ongoing organic discovery.

Investor quote:“Most of Danelfin’s growth is organic, SEO-driven, or via viral sharing among trading communities.” (source)

Why this works:

People searching for stock picks or trade ideas are already “warm leads”—primed to act. Combine that with high-credibility data and transparent, research-backed claims, and the conversion funnel is powerful.

Lessons for Indie Developers and Small Teams

- Pick a real, painful problem, then double down on trust and transparency.

- If your market values proof, invest in deep, credible product-building—even at the cost of speed.

- Let your product drive your content strategy (not the other way around)—turn every feature, score, and result into content that brings in targeted, ready-to-buy users.

- Don’t be afraid of complex tech if you can output simple, understandable results for users.

- Leverage the “freemium trap”: tease with utility, then let natural curiosity and usage friction pull upgrades.

Final Thoughts

AI-driven investing is a crowded, often overhyped market—but Danelfin’s pragmatic approach shows what it really takes: credible founders, patient R&D, user-centric transparency, and content that works just as hard as the algorithms.

For indie makers tracking “AI + money” opportunities, the real lesson is old-fashioned: Depth, trust, and patient build can still win—even in the age of viral growth hacks.

For more on Danelfin, see their official page.On the rise of AI investing tools: WSJ: “The Rise of AI Stock Pickers” (2023)

Original analysis adapted for English-speaking, AI-focused readers (2024).