AI-Driven Stock Insights for Everyday Investors

Vivi Carter · 21, July 2025

Why I’m Doing This: Learning From Real-World AI Winners

As someone fascinated by AI entrepreneurship, I’ve set myself a mission: Each day, I investigate a successful overseas AI product in-depth. I dissect their product strategy, growth hacks, SEO, and cold start tactics, with a tilt toward what independent developers and small teams might actually apply. My goal is to learn, not just admire.

And trust me—I set a time limit. Two to three hours tops. I’m fully aware that my take might miss a detail here or there, so feedback is always welcome.

Today’s Focus: levelfields.ai

Recent editions of my series have zoomed in on AI tools related to stocks, especially in the U.S. market. Why? Few things crank up a product’s revenue-per-user like investing. Case in point: some of these platforms manage to generate nearly $10k in monthly recurring revenue with less than 100 users! Stock-picking clearly isn’t a soft want—it’s a hard-needs industry.

That brings me to today’s deep dive into a rather unique angle with levelfields.ai.

What is levelfields.ai? Reinventing the Playbook for Retail Investors

At its core, levelfields.ai is a fintech tool built for “event-driven investing”. It claims to level the playing field, arming regular investors with AI tools to identify market-moving events—the type typically exploited by the pros.

No “AI magic box” promising instant wealth here. The idea is more pragmatic: give individuals the resources to act on actionable market catalysts (think: CEO changes, big contracts, regulatory shifts) before the window closes.

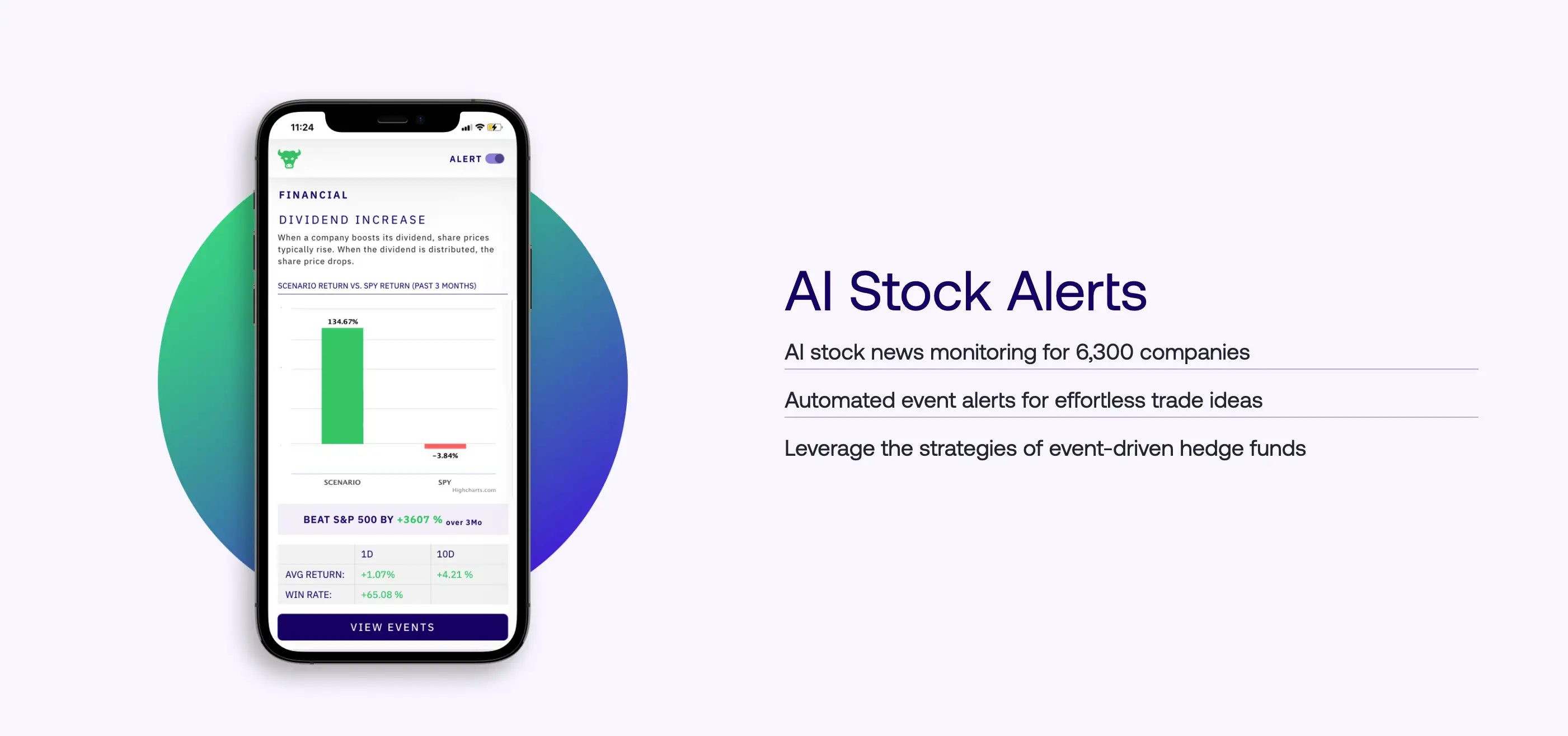

Key Features Rundown

| Function | Description |

|---|---|

| AI Event Extraction | Natural language processing combs SEC filings, news, press releases, and even social media to spot impactful company events. |

| Historical Backtesting | For each event type, historical performance is surfaced so users can see what happened to stocks in previous, similar scenarios. |

| Real-Time Alerts | Custom strategies enable instant email/SMS alerts once a relevant event drops. |

| Scenario-Based Strategies | Over 100 prebuilt “event-driven” strategies. Like ordering from a menu, users can pick the catalysts they care about most. |

| Watchlist and Portfolio | Track and monitor chosen tickers or sectors, real-time. |

| Transparent Data | For every event, frequency, average price change, and ideal entry/exit timing are provided. |

Notably, this is the brainchild of a team with backgrounds in institutional event monitoring for governments, corporations, and hedge funds. They transplanted those algorithmic approaches into something retail investors can use.

Aggressive Pricing That Nudges Annual Commitment

Here’s where things get spicy: levelfields.ai asks for $99 a month—basic tier. But, annual payment is only $299. It’s a textbook behavioral nudge: you could pay monthly, but the annual deal is almost irresistible by comparison (source). Clearly, confidence in the product is sky-high—they’re not chasing mass-market, low-cost users. They know their value.

The Backstory: How levelfields.ai Got Off the Ground

Founder Andrew Einhorn isn’t new to enterprise analytics. He previously led a media intelligence business catering to B2B and government clients, building real-time monitoring for major institutions—and even advising a hedge fund or two. The core team worked together before, so the startup had both the technical chops and financial networks from the start.

The spark for levelfields.ai? The tumultuous pandemic market of 2020. Einhorn saw how big money was quietly making bank off “event-driven” plays, while retail investors were left guessing. He set out to “democratize” those institutional-grade tools for everyday users.

How They Grow: Beyond Product—It’s About Story, SEO, and Social Proof

1. Content Marketing and SEO

If you Google “AI stock picking” or “event-driven investing,” you’ll bump into levelfields.ai’s news section—part blog, part finance magazine. Their content game is pro-level, leveraging their event-driven insights to comment on hot, newsworthy investing themes (source: SimilarWeb traffic distribution).

Plus, they aren’t shy about going head-to-head with investment media giants. A regular tactic: articles comparing themselves with the likes of Motley Fool, roping in users already primed to buy.

- 42% of site traffic is organic search.

- Combining education and product promotion, they gently guide readers from learning to trial.

2. Social Proof and Word of Mouth

Referral systems are robust—bring two friends, get a cash rebate. And the homepage is filled with testimonials like “Made back 10x my subscription on my first trade.” It’s classic direct-to-consumer playbook.

3. The Founder's Persona

Einhorn leverages credibility like a pro—regular podcast appearances, guest interviews, and personal stories tie back the brand to something tangible and trustworthy in a sector often seen as hyped or scammy.

User Experience: The Good, The Bad, and the Honest

It’s not all sunshine. A quick glance at Reddit or finance forums shows:

- Pros: Many users praise time savings in filtering news and enjoying early event insights.

- Cons: Criticism around lagging signals, spotty customer service, and difficulty getting refunds isn’t rare (see Reddit reviews). Some lament that real investment returns don’t always match the hype—caveat emptor.

“The real value is in serving as an information accelerator, not as a guaranteed moneymaker. The AI is great, but you still need to vet the final investment call.”

— typical sentiment among candid users

Key Takeaways for Indie Builders and Startup Teams

Niche Focus Wins:

Instead of making an “AI for everything” platform, levelfields.ai picked event-driven stocks and went deep.

Transplant Tech, Don’t Reinvent:

They adapted event-monitoring infrastructure from enterprise to retail with focus, not breadth.

Content + Founder Visibility = Trust:

SEO, educational content, and media presence matter more (especially for high-trust products) than big ad spends.

Word of Mouth is King:

Referral rewards and showcasing wins get new users and keep the churn rate down.

Always Keep Improving:

Early complaints stung, but continuous product fixes and support improvements kept them moving.

Final Word

levelfields.ai is no miracle stock picker, but it’s a telling example of how precision, story, and strategic marketing can carve out a thriving SaaS niche, even against entrenched players. For anyone serious about building in the AI x fintech space, their playbook has lessons worth studying—and adapting.

References:

- Pricing, product, and growth strategies: levelfields.ai

- User and traffic data: SimilarWeb

- User feedback: Reddit

- Context on behavioral pricing: Harvard Business Review

Relevant Resources