Unify's $52 Million Bet: AI-Native Sales for a Noisy Era

.webp)

Eric Walker · 21, July 2025

For most of the 2010s, pipeline growth looked like a simple math problem: hire more SDRs, buy ever-bigger contact lists, and blast out another few thousand emails before lunch. But the inbox has caught up with the tactic. Average email open rates in B2B now hover around 30 %—and that’s the good industries—while click-throughs sit under 3 %. HubSpot’s 2024 sales benchmark shows little improvement on the closing side: more than half of reps say win-rates are flat or falling.

Reps feel it first. Instead of talking to prospects, they bounce between enrichment tools, intent dashboards, and sequencing software, trying to stitch together a coherent story about who actually cares right now. The result is bloated SDR teams chasing weaker leads, while CAC climbs and quota attainment drops.

From Guesswork to Signals: Inside Unify

Enter Unify, an AI-native go-to-market platform that closed a $40 million Series B—just nine months after its $12 million Series A. Co-founders Austin Hughes (ex-Ramp growth) and Connor Heggie (ex-Scale AI) argue that outbound no longer needs more volume; it needs better timing. They frame the problem as a search task over messy, real-world data instead of a copy-writing contest.

The Three-Layer AI Stack

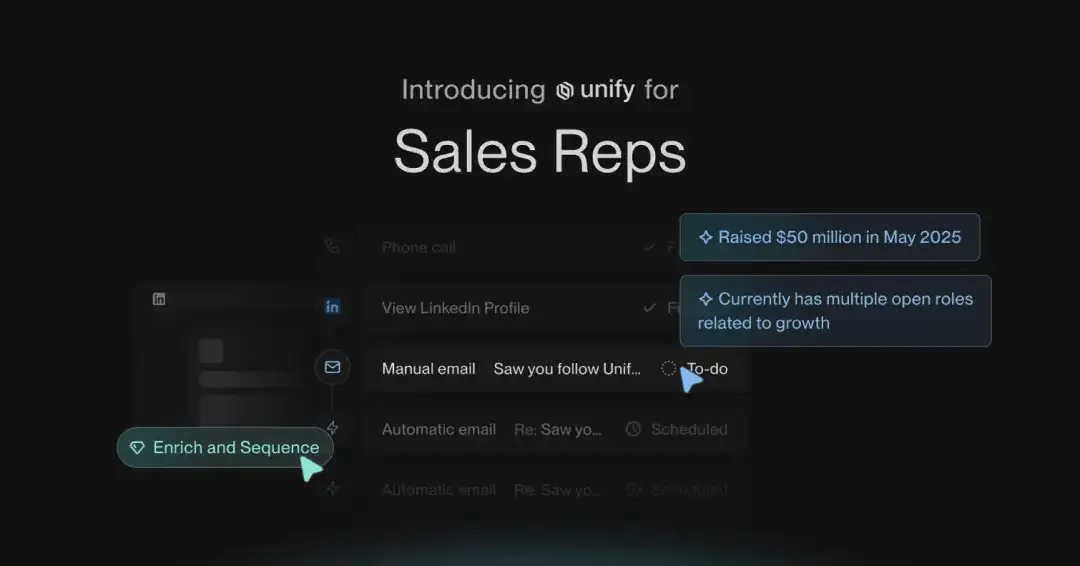

- Observation Model – A background “crawler” powered by OpenAI o3 continuously scans public signals—new hires, tech-stack shifts, funding events—and assigns each account a propensity score.

- Research Agents – A fleet of task-specific agents (planning in GPT-4.1, live-web navigation via a computer-use agent, synthesis in GPT-4o) answers open-ended questions like “Why is Acme suddenly trial-sign-ups heavy in Europe?”

- Copy Generator – Using the freshest signals, it drafts hyper-specific outreach—one email per lead that references the event, the buyer’s role, and suggested next steps.

Unify’s team tested multiple models for each layer and found that o3 delivered 83 % accuracy on firmographic classification—well ahead of frontier peers.

Why VCs Wrote the Check

Battery Ventures led the round, with OpenAI’s Startup Fund, Thrive, and others piling on. The bet rests on three converging trends:

- Workflow engineering beats headcount. GTM teams now look for builders who can wire APIs and agents together instead of “smile-and-dial” rookies.

- Quality is the new bottleneck. Raw pipeline is easy; qualified pipeline is scarce.

- Generative AI is moving from assistive to autonomous. If agents can handle research, list building, and first-touch messaging, a single seller can outperform yesterday’s 10-person pod.

Unify claims 8× revenue growth in the last year, with customers generating “hundreds of millions” in pipeline and an ARR run-rate of $5.6 million as of June.

Real-World Stress Tests

- Cursor – The breakout AI code editor saw a traffic surge during rival Windsurf’s acquisition drama. Unify’s agents filtered thousands of anonymous visitors and routed only high-fit accounts to reps—avoiding the usual brand-damaging email carpet-bomb. Cursor, whose parent Anysphere just hit a $9 billion valuation, credits the system for keeping its tiny sales team ahead of demand spikes.

- Navattic – By matching free-trial users with vertical-specific success stories, Navattic booked $100 k in qualified pipeline and 10 meetings in its first week on the platform.

- Perplexity – Product-led growth means timing is everything. Perplexity’s PMM lead says Unify’s intent triggers “drop meetings in our sellers’ inboxes the moment a user account crosses a usage threshold.”

Free perplexity available on GlobalGPT, an all-in-one AI Platform.

A Friendly Rivalry with Clay

Power users often run Clay for deep enrichment and Unify for execution. Clay is the tinkerer’s playground; Unify is the out-of-the-box command center a frontline rep can trust at 7 a.m. Hughes stresses that Unify’s goal isn’t to build a fully autonomous “AI SDR” that replaces people. It’s to give fewer sellers super-powers: think Iron Man suit, not Terminator.

Risks and Open Questions

- Noise Arms Race – If every vendor personalizes at scale, do buyers just raise the drawbridge? Hughes argues relevance wins: when the outreach teaches you something about your own market, you don’t care whether a human or a model penned it.

- Model Reliability – Even a 95 % accurate agent still fumbles. Unify keeps a human-in-the-loop on final send for now—a sensible guard-rail as legal regs around automated communication tighten.

- Big-Tech Imitation – Salesforce, HubSpot, and Microsoft all have the model chops to build similar features. First-mover advantage will hinge on speed of iteration and UX focus, not secret sauce.

The Next 24 Months

Expect the stack to widen. LinkedIn DMs are already live; dialer and product-usage triggers are in beta. Longer term, pricing may shift from per-seat SaaS to performance—pay for pipeline created or deals closed. And yes, fully autonomous agents will creep down-funnel: imagine ChatGPT negotiating a redline before the AE hops on Zoom.

For revenue leaders, the takeaway is clear: outbound’s center of gravity is moving from “spray” to “sense.” Whether you buy Unify, build internally, or try the next contender, the question is no longer if AI will reshape go-to-market—it’s whether your sellers will be lifting or surfing the wave.