From Zero to $280M: The AI Money App Revolution

Vivi Carter · 3, August 2025

A Quiet Revolution in AI Personal Finance

Can you imagine a financial AI company doubling its annual revenue and turning a profit—all in just one year? This is exactly what Cleo, a UK-based financial assistant startup, recently announced. Founder Barney Hussey-Yeo shared on LinkedIn that Cleo surpassed $280 million in annual recurring revenue, doubled its top line in 12 months, and has become profitable. In a sector known for slow growth—personal finance—these numbers are not just uncommon, they're almost unheard of.

Curious how this company upended the “slow and steady” myth of personal finance technology, I started tracing Cleo’s journey and discovered that this was more than a story of product success. It’s about how AI is transforming an entire industry, democratizing financial intelligence once reserved for the wealthy, and about how a young founder’s audacity set the foundation for potentially a billion-dollar company.

Staggering Growth in a Surprisingly Old-School Industry

Let’s break down the numbers: Cleo now boasts over 850,000 paying subscribers, $280 million in annual recurring revenue, and—crucially—profitability. This is an anomaly in the SaaS world, where rapid user acquisition often comes at the cost of immense operational losses. Cleo has consistently doubled its subscriber base every year since 2021—a rare feat in the hyper-competitive world of consumer fintech.

When you compare this performance with traditional players like Mint or Personal Capital, the contrast is stark. Those platforms needed years to achieve comparable scale and typically depended on advertising revenue rather than direct subscriptions. Cleo, however, has achieved both rapid user growth and a robust paid model—with average annual user spend at around $329, an impressive figure in personal finance.

Why is this happening now? Cleo has cleverly targeted Gen Z and younger millennials, a group struggling with student debt, soaring housing costs, and stagnant wages. They also carry historically high levels of distrust toward traditional banking, and Cleo’s playful AI-driven approach is a perfect fit for their needs. In this way, Cleo has created not just a product but an entire ecosystem tailored to a new generation.

More than just growth, Cleo stands out for sustainable user value. User engagement is reportedly 20x higher than legacy banking apps, and over 85% of new users feel better about their finances after just a month. The engine behind this? A mature data pipeline: the company processes over 8.2 million daily transactions, continuously enhancing its machine learning capabilities—a true AI “data flywheel.”

On the investment side, Cleo has raised $138 million from top-tier VCs like Balderton, EQT, and Sofina. But, thanks to profitability, the company no longer depends on outside capital. According to recent interviews, they’re prepping for an IPO once annual revenue surpasses $500 million—a milestone that now looks well within reach.

Sifted: "Cleo, the only European fintech to crack the US" (2024)

Cleo 3.0: From Passive Tool to Proactive Financial Agent

What really sets Cleo apart is its latest technological leap. Legacy personal finance apps tend to serve as passive ledgers—you enter transactions and run simple reports. Cleo 3.0 takes a radically different approach. It functions as an active, memory-enabled, reasoning AI agent—more like a human advisor than a digital spreadsheet.

The launch of its agentic architecture is a fundamental paradigm shift. Old versions of Cleo required users to manually set budgets or click through menus. Now, Cleo’s agent interprets requests, deploys the right tools, even loops through tasks as needed until completion. For simple queries, a single action might suffice. For complex ones—like validating eligibility for wage advances—Cleo synchronizes multiple steps behind the scenes.

Cleo’s deep integration of retrieval and action tools means users get both context-rich answers and true automation, not just digital handholding. The system can proactively mine six months of transaction data, spot emerging trends, and surface actionable insights—before you even know what to ask.

This predictive capability, supported by OpenAI’s latest LLMs, elevates Cleo into a 24/7 active financial analyst for its users (OpenAI, “GPT-4o Research,” 2024). For users, this means fewer repetitive prompts and a greater sense that their financial story is understood holistically.

Adding speech—to—text and text-to-speech pipelines, plus a playful, reactive avatar, transforms the interface into something inviting rather than intimidating. Cleo’s voice-based gamification (such as money quizzes and challenges) makes financial management not only more interactive, but genuinely fun.

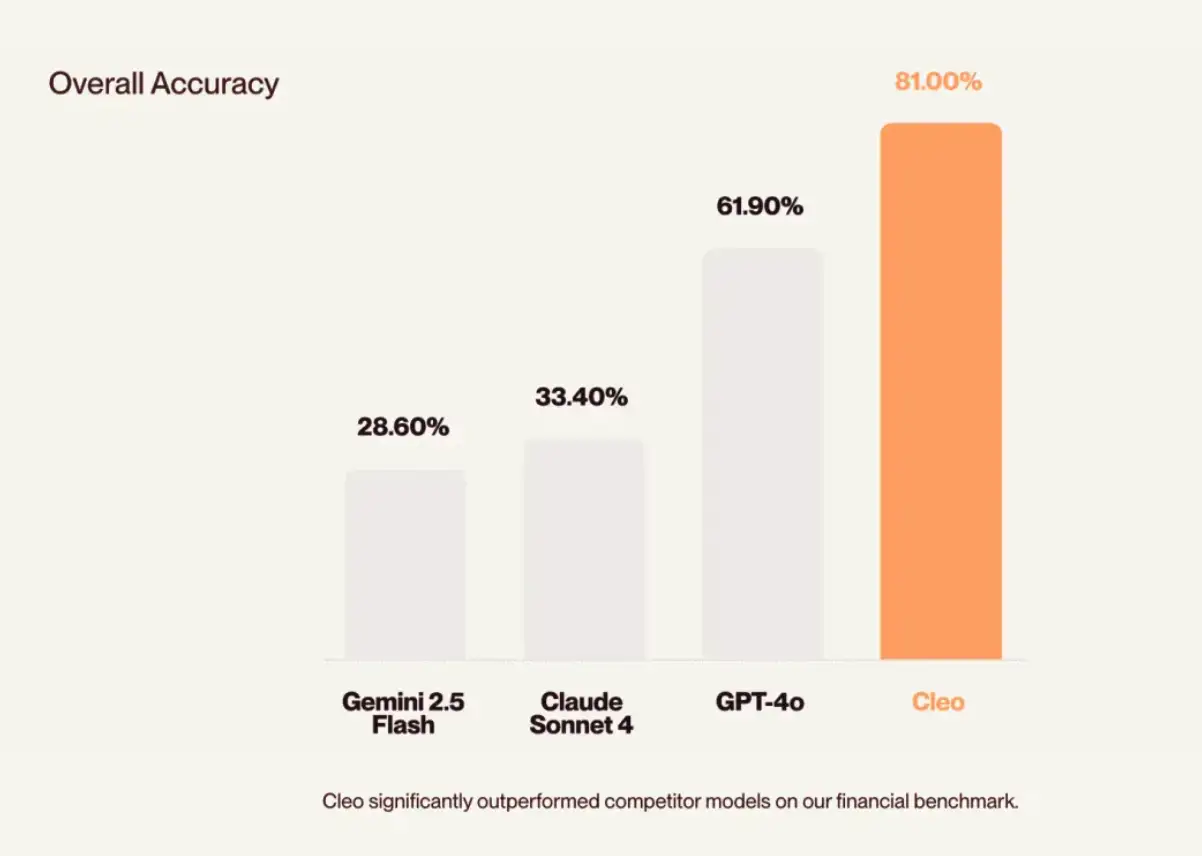

From a technical standpoint, Cleo 3.0’s hybrid design—combining deterministic logic where precision is needed with generative models for interaction—yields industry-leading accuracy (81% in recent benchmarks, outperforming OpenAI, Anthropic, and Google’s offerings in key budgeting tests).

The Founder Factor: Ambition, Execution, and Market Read

Behind Cleo’s rise is Barney Hussey-Yeo: a founder with a rare blend of technical depth, clarity of vision, and a pinch of self-confessed “megalomania.” With a master’s in ML and early stints as a data scientist, he directly experienced the disconnect between everyday consumers and the financial tools designed for them.

Hussey-Yeo’s pivotal insight: most people don’t want complex charts—they want personalized, human conversations about money. Cleo’s early success was catalyzed by a simple, semi-fake demo of a chatbot giving financial “sass” like a funny friend. User response was overwhelming, confirming that finance does not have to be dry or joyless.

From managing a handful of coders to leading 400-plus globally, his leadership and strategic U.S. market focus has also been key. To quote Sifted, Cleo stands out as "the only European fintech to crack the U.S. market.”

A Tectonic Shift: AI as the Great Equalizer in Finance

Cleo’s success is not just about beating Mint or YNAB; it points to a much deeper industry shift. Traditionally, financial advice was a luxury for the affluent, while regular people were left with generic tools or unaffordable expert help. AI finally makes personalized financial guidance accessible on a massive scale.

Gen Z and Millennials—who grew up with Alexa, Siri, and ChatGPT—naturally trust AI-powered helpers. Cleo leverages this paradigm, combining a playful, irreverent brand with robust data analytics. By introducing elements of gamification, financial literacy suddenly feels less like homework and more like a journey.

Competition in personal finance is no longer about sharper charts or snazzy dashboards—it's about who offers meaningful, proactive insights paired with a genuinely engaging user experience. Cleo’s data advantage and early adoption of full-stack AI guard its lead—for now.

What’s Next? Beyond an Assistant, Toward an AI Financial Ecosystem

Cleo’s roadmap stretches well beyond a chat app. The upcoming Finhealth Score aims to capture a user’s overall financial wellbeing—like a next-gen credit score, but factoring in saving habits, budgeting, and behavioral change. Visualizations and analysis will become fully integrated into chats, and account aggregation across banks and asset classes will finally give users a panoramic view of their finances.

This is the holy grail for personal finance tech: breaking down data silos and offering cross-account, cross-category insights. For users, Cleo promises to become the nerve center of their financial lives—a true AI teammate rather than a glorified calculator.

Rethinking the Future of Fintech

Cleo is proof that AI, when combined with real user empathy and bold execution, can redefine an entire industry’s trajectory. The company’s journey—from an ambitious founder’s bedroom prototype to a $280-million-revenue fintech powerhouse—epitomizes not just technological evolution, but a cultural one. Here, “democratizing AI” is not just a buzzword: 85% of users report a better understanding of their finances, and millions are not only using Cleo, but expressing genuine gratitude for it.

There are still hurdles: as AI-powered assistants manage ever more sensitive data, privacy and explainability will be paramount. But Cleo’s success marks a turning point—it’s a playbook for how AI can empower, not just replace, professional expertise across the board.

Cleo’s story isn’t just a case study; it’s a signal that tech, used wisely, can solve real problems and unlock new possibilities for millions. The age of intelligent, accessible, and delightfully human financial assistants has truly arrived.

Relevant Resources