Perplexity Finance est la branche d'analyse financière de Perplexity AI, un moteur de recherche rapide et conversationnel conçu pour vous donner des réponses directes plutôt que des liens sans fin. Il vaut la peine de l'utiliser si vous souhaitez obtenir rapidement des informations explicatives sur les actions, les bénéfices ou l'actualité du marché, mais il ne remplace pas complètement les outils financiers plus approfondis. Pour une compréhension rapide, c'est l'un des assistants financiers basés sur l'IA les plus rapides disponibles aujourd'hui, même si les décisions critiques en matière de précision nécessitent toujours une vérification croisée ou une association avec une plateforme multimodèle.

La plupart des utilisateurs n'ont pas besoin d'un modèle parfait, mais de réponses fiables. Perplexity Finance est rapide, mais la rapidité n'est pas synonyme de précision, et le moyen le plus sûr de garantir la fiabilité est de recouper les informations issues de plusieurs modèles de pointe.

C'est là qu'un espace de travail multimodèle comme GlobalGPT devient précieux. Il vous offre une deuxième couche de vérification alimentée par GPT-5.1, Claude 4.5, Gemini 3 pro, et d'autres modèles haut de gamme en un seul endroit. Si vous souhaitez obtenir rapidement des informations et précision fiable, Combiner Perplexity avec GlobalGPT est l'un des dispositifs de recherche les plus intelligents en 2025.

Qu'est-ce que Perplexité La finance, et pourquoi les investisseurs en ont-ils besoin aujourd'hui ?

Les marchés financiers évoluent plus rapidement que jamais : les entreprises à très forte capitalisation franchissent le cap du billion de dollars, les actions enregistrent des hausses à deux chiffres du jour au lendemain et les changements macroéconomiques se répercutent sur tous les secteurs en quelques minutes. Les investisseurs n'ont plus de mal à trouver des informations. Ils ont du mal à comprendre rapidement.

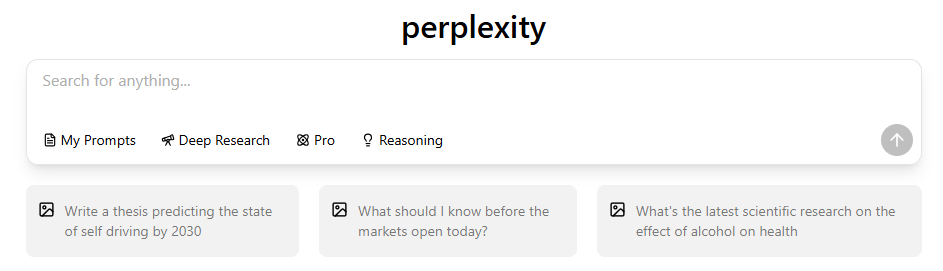

Perplexity Finance vise précisément à résoudre ce problème. Il utilise le moteur de recherche “ question → réponse ” propre à Perplexity et l'applique aux actions, aux résultats financiers, aux documents déposés auprès de la SEC et aux événements macroéconomiques. Au lieu d'ouvrir une douzaine d'onglets, vous obtenez en quelques secondes une analyse structurée et lisible.

Il s'articule autour de trois points sensibles pour les investisseurs modernes :

- Trop de bruit : les articles sont longs, fragmentés et répétitifs

- Cycles de recherche lents : Les dépôts 10-K et les PDF sur les résultats prennent du temps.

- Absence d'explications en anglais simple : la plupart des contenus financiers supposent une expertise

Perplexity condense tout cela en réponses rapides et lisibles. Il est particulièrement utile pour :

- débutants apprenant les marchés

- professionnels très occupés effectuant rapidement une vérification préalable

- investisseurs qui souhaitent obtenir rapidement un aperçu général avant d'approfondir leurs recherches

Quel est le degré de fiabilité ? Perplexité Finance ? (Précision, données et limites)

Perplexity Finance extrait ses données des communiqués de presse sur les résultats financiers, des documents déposés auprès de la SEC, des actualités financières et des flux de données boursières. Pour les grandes entreprises bien couvertes, la précision est généralement élevée : les chiffres tels que le chiffre d'affaires, les tendances des marges et la croissance annuelle correspondent aux documents officiels.

Mais la fiabilité varie selon les situations :

- Actions à faible capitalisation les données peuvent être incomplètes ou différées

- Informations contradictoires peut entraîner des interprétations simplistes

- Comptabilité complexe est parfois condensé de manière trop agressive

- Actifs cryptographiques ou faiblement couverts montrer la plus grande variance

La perplexité est excellente pour une compréhension rapide, mais elle ne doit pas être considérée comme une référence absolue pour les décisions où la précision est essentielle.

Quoi ? Perplexité La finance fait-elle mieux ?

Voici les tâches pour lesquelles Perplexity Finance apporte une valeur ajoutée maximale :

1. Résumés instantanés des gains

Perplexity extrait les chiffres clés directement des communiqués de presse sur les résultats financiers et des documents déposés auprès de la SEC, puis les restructure pour en faire un aperçu lisible. Vous obtiendrez le chiffre d'affaires, la marge brute, le résultat d'exploitation, la croissance annuelle et même les commentaires de la direction, le tout en un seul défilement.

2. Aperçus rapides des stocks

Si vous effectuez des recherches sur une nouvelle entreprise et souhaitez obtenir une vue d'ensemble claire, Perplexity vous fournit l'essentiel :

- Activité de l'entreprise

- Principaux moteurs de revenus

- Principaux indicateurs financiers

- Concurrents

- Catalyseurs de croissance ou risques

3. Comparaisons avec la concurrence

Au lieu d'extraire manuellement les ratios cours/bénéfice, les taux de croissance ou les marges, Perplexity compare les entreprises entre elles.

Il crée des tableaux clairs résumant les tendances en matière d'évaluation, de rentabilité et de performance.

4. Explications relatives à l'impact des actualités

Perplexity ne se contente pas de vous dire ce qui s'est passé, il vous explique pourquoi. pourquoi c'est important. Pour les mouvements importants, comme une hausse de +20% ou une chute soudaine, il se connecte :

- communiqués de l'entreprise

- partenariats

- actualités réglementaires

- déclencheurs macro

5. Filtrage rapide de diligence raisonnable

Lorsque vous vous demandez si une action mérite une analyse plus approfondie, Perplexity vous donne rapidement un aperçu pour vous aider à décider si vous devez “ continuer à creuser ”.

Il met en évidence :

- risques majeurs

- facteurs de croissance

- signaux d'alerte

- position concurrentielle

- dynamique récente des bénéfices

Où Perplexité Les finances sont insuffisantes ?

Malgré ses points forts, cet outil présente de réelles limites :

- Pas de cartographie approfondie (pas de chandeliers, d'indicateurs ou de graphiques pluriannuels)

- Pas de filtre boursier complet

- Simplification excessive occasionnelle sur des sujets complexes en matière de comptabilité

- Ne convient pas pour une profondeur de niveau institutionnel

- La mémoire contextuelle est limitée au cours de longues discussions

Ces faiblesses ont leur importance si vous vous appuyez fortement sur la modélisation ou l'analyse avancée.

Est Perplexité La finance est-elle utile pour la recherche boursière ?

Perplexity Finance est très efficace pour une utilisation rapide, recherche boursière axée sur le récit. Ses points forts sont particulièrement visibles dans les domaines suivants :

1. Expliquer rapidement ce qui motive le mouvement d'une action

Perplexity identifie les principaux catalyseurs à l'origine des hausses ou des baisses soudaines, en reliant l'actualité, les résultats financiers, les tendances sectorielles et le sentiment dans une explication claire et unique, au lieu de répéter les gros titres.

2. Regrouper plusieurs sources d'informations pour former un récit cohérent

Il rassemble les commentaires sur les résultats, les articles d'actualité, les documents déposés et les mises à jour macroéconomiques dans un récit structuré. Cela vous aide à comprendre le contexte plus large qui sous-tend les mouvements ou les tendances d'une entreprise.

3. Fort dans l'interprétation des mouvements dictés par les événements

Qu'il s'agisse d'un investissement stratégique, d'une annonce de partenariat, d'un changement d'orientation ou d'une mise à jour réglementaire, Perplexity peut relier l'événement à des tendances historiques et au comportement du secteur, offrant ainsi un contexte plus utile que les actualités traditionnelles.

4. Explications claires des répercussions macroéconomiques sur les secteurs

Pour les décisions de la Fed, les publications de l'IPC ou les variations des rendements, Perplexity distingue les discours bellicistes des discours conciliants et explique comment les valeurs technologiques, les semi-conducteurs ou les valeurs de croissance réagissent généralement.

5. Idéal pour une sélection rapide et une diligence raisonnable à un stade précoce

Il n'est pas conçu pour la modélisation approfondie, mais il est parfait pour :

- déterminer si une action mérite d'être étudiée plus en détail

- Comprendre les principaux risques et catalyseurs

- obtenir rapidement une vue d'ensemble avant d'approfondir le sujet

Mode d'emploi Perplexité Financer en toute sécurité

Pour éviter les erreurs et les hallucinations :

✔ Toujours vérifier les chiffres des revenus

Utilisez les documents déposés auprès de la SEC lorsque la précision est importante.

✔ Utilisez un flux de travail à deux niveaux

Perplexité pour la vitesse → GlobalGPT pour la vérification.

✔ Évitez de vous fier aux prévisions générées par l'IA.

Utile d'un point de vue directionnel, mais non exploitable.

✔ Soyez prudent avec les actions à faible capitalisation.

Les lacunes dans la couverture augmentent les taux d'erreur.

Gratuit vs Pro: De quoi avez-vous besoin ?

| Fonctionnalité | Plan gratuit | Pro Plan (201 TP4T/mois pour un abonnement personnel) |

| Recherches de stocks en temps réel | ✔️ Citations et graphiques de base | ✔️ Données complètes sur le marché, horaires prolongés |

| Résumé des résultats | ✔️ Résumés courts | ✔️ Ventilation détaillée + commentaires de la direction |

| Analyse des documents déposés (10-K/10-Q) | ❌ Non inclus | ✔️ Extraction des documents déposés auprès de la SEC grâce à l'intelligence artificielle |

| Vérification multi-sources | ✔️ Limité | ✔️ Raisonnement intermodèle + synthèse multisource |

| Comparaisons avancées (P/E, marges, comparaisons) | ❌ Ratios de base uniquement | ✔️ Tableaux comparatifs complets des concurrents |

| Analyse de l'impact des actualités | ❌ Titres uniquement | ✔️ Explications des raisons pour lesquelles cela a changé |

| Rapports approfondis | ❌ Non disponible | ✔️ Notes de recherche entièrement rédigées par l'IA |

| Modèles d'IA disponibles | Modèle public uniquement | GPT-5.1, Claude 4.5, Gemini 3, Grok 4 (varie selon la région) |

| Limite quotidienne de requêtes | Limitée | Élevé ou illimité (varie selon le forfait) |

| Extension de navigateur | ❌ Non inclus | ✔️ Inclus |

| Espaces, fils personnalisés | Limitée | ✔️ Calcul prioritaire |

Si vous utilisez Perplexity pour vos recherches quotidiennes, La version Pro en vaut la peine. Sinon, la version gratuite couvre la plupart des cas d'utilisation.

Lire la suite

Perplexity Student Discount : Comment obtenir Perplexity Pro gratuitement en 2025

Perplexité gratuite pour les étudiants : Comment obtenir un accès pro en 2025

Perplexité Finance vs autres outils

| Outil | Points forts | Faiblesses | Meilleur pour |

| Finance de la perplexité | Explications instantanées, résumés clairs, aucune configuration requise | Visuels limités, raisonnement basé sur un seul modèle | Informations quotidiennes rapides sur les actions |

| Yahoo Finance | Graphiques riches, données historiques complètes | Interprétation lente, beaucoup de bruit | Analyse visuelle et navigation dans les données |

| Terminal Bloomberg | Données institutionnelles approfondies, meilleures analyses | Très coûteux, interface utilisateur complexe | Analystes professionnels et fonds |

| ChatGPT + Plugins | Analyse flexible et personnalisable | Nécessite des invites, des plugins, des suivis | Utilisateurs qui souhaitent des flux de travail personnalisés |

| GlobalGPT | Vérification multimodèle (GPT-5.1, Claude 4.5, Gemini 3), précision accrue | Une interface utilisateur non spécifique à la finance | Recoupement, réduction du biais du modèle |

Est Perplexité La finance en vaut-elle la peine ? (Verdict final)

Oui, si vous recherchez la rapidité, la clarté et une compréhension rapide du marché. Non, si vous avez besoin de graphiques avancés, de modèles détaillés ou de données institutionnelles. précision.

Perplexity Finance excelle dans la transformation d'informations complexes sur les marchés en analyses simples et lisibles. Rapide et intuitif, cet outil est idéal pour comprendre les facteurs qui influencent une action ou un secteur sans avoir à parcourir de longs documents ou de multiples onglets d'actualités.

Il convient particulièrement pour :

- Investisseurs particuliers qui veulent des explications claires

- Professionnels très occupés besoin d'un contexte rapide

- Due diligence légère ou préliminaire

- Questions financières quotidiennes et interprétation de l'actualité

Cela ne remplace pas une analyse financière approfondie.—mais c'est l'un des meilleurs outils disponibles pour une compréhension rapide et de haute qualité du marché.

Perplexité + GlobalGPT : L'intelligence Flux de travail

Perplexity vous apporte la rapidité. Il rassemble les informations clés en quelques secondes et vous aide à comprendre rapidement ce qui motive l'évolution d'une action ou d'un marché.

GlobalGPT vous apporte la certitude. Avec accès à GPT-5.1, Claude 4,5, Gémeaux 3, et d'autres modèles de pointe, vous pouvez vérifier les chiffres, recouper les explications et obtenir un raisonnement plus approfondi qu'un seul modèle ne peut fournir.

Ensemble, ils créent un flux de travail qui est :

- rapidement — Perplexity gère l'analyse initiale

- précis — GlobalGPT valide et développe les connaissances acquises.

- fiable — plusieurs modèles réduisent le risque d'erreurs

C'est l'un des moyens les plus efficaces et les plus fiables pour étudier les marchés en 2025.